Recently, we were thinking about Deflation. Let’s take a look at the next ion in our inventory….the often referenced but little understood ion…Inflat-ion.

As you probably know or can sense, central bankers, with the possible exception ofGermany…who had a nasty dose of it in the 1920s – are gloriously enamored of inflation. They want more of the stuff. For gosh sakes, Gentle Ben even did his thesis on why inflation is divine and deflation is evil.

So the central bankers…you know…the Fed, ECB, Bank of Japan (more on them in a minute) print like there’s no tomorrow. Do they know something we don’t? I suspect not. More like they don’t know what they don’t know. And what they don’t know might hurt them…and probably will hurt us.

So the bankocrats print money (remember, it does grow on trees after all) and that money finds its way to their banker friends and that’s where it sits…for now. But under the fractional reserve banking system that these geniuses devised, once that money gets out and about and attains some “velocity”, it can be quite a chore to get it back under control…just ask Paul Volcker.

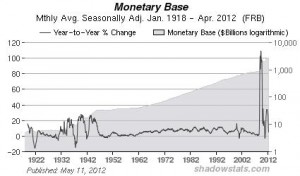

So while we have deflationary influences, a heck of a lot of money is out there…just waiting for it’s chance to really rumble. Take a look at the graph below courtesy of John Williams at ShadowStats (who actually tells it like it is…not the way our government would have you believe…certainly an inconveniently truthful site you might consider worthy of visiting).

See all that gray stuff sloshing around. That’s money…well, printed currency anyway.

We’ve already seen the early effects resulting from QE 1 and 2. The money went to the banks who either hoarded it or used it to speculate on real stuff (like grains and gold) which pushed the prices of many of our normal commodities higher. It’s all supply and demand which resulted for us regular folks as sort of trickle-down economics…but not the way Reagan envisaged. For us wee folk, this trickle-down effect comes in the form of higher prices…at the pump and at the supermarket. Have you ever noticed how food products are either getting more expensive or are shrinking in size…or both? That’s the insidious effects of inflation in action. Notice that I did not say that it is inflation per se. Also interesting that the “official” CPI excludes the two essentials that are most affected by inflation…energy and food. Go figure?

And after all, what really is inflation anyway? We’ll give you a hint…it’s as simple as Sally telling Harry that he’d better buy something essential with that paper in his pocket today because it’s likely to buy less of that essential tomorrow.

So that’s why we answer “yes” when asked if we will have deflation or inflation. We already have both…it’s just a question of where you look.

Spare a thought for Mrs. Fukunaga…and wonder…could it happen here?

Speaking of which, let’s take a quick look over to the Land of the Rising Sun, where the Japanese government is once again putting the slipper into poor Mrs. Fukunaga. For years, Mrs. F and all her fellow loyal Japanese citizens saved diligently and bought JGBs (Japanese Government Bonds).

For the last couple of decades, they received a pittance in interest as the government shuttered rates and unleashed the printing press.

This lack of interest now means that poor old…yes, she is not as sprightly as she once was…she is part of the 23% of Japanese who are over 65…has not allowed Mrs. F. to accumulate enough interest to live off. So she and her cohort are having to spend their principal to survive.

How does the Japanese government reward her loyalty for saving all these years via their JGBs. Of course, they do what bureaucrats do so well…they stick it to her…by increasing the current consumption tax by 100%…from 5% to 10%.

So think about this for a moment. Mrs. Fukunaga did the right thing all her life. She worked, she saved, she invested in Japan (95% of Japanese debt is domestic). In return, she got paltry rates of interest that require her to now invade principal to survive….and all the while, the government squandered trillions of yen in a failed Keynesian attempt to stimulate an inherently flawed economy (Japan has the worst debt to GDP ratio in the world at over 200% and is a debt bubble looking for a pin).

So now they sock it to poor, increasingly old Mrs. F as she consumes her remaining savings…the government collecting a 10% stipend as she spends down to survive. Could it happen in the good old US of A. You better believe it.

Incidentally, “itai” is Japanese for “ouch”. How soon until we all start feeling a lot more pain. Don’t say we didn’t warn you.