Well…another week and another seven hundred million dollars ($700,000,000) added to the national debt. We’re now over 15.9 trill and on record pace to hit 16 trillion. Wow…if this were an Olympic race, this would be a world record for the ages. Unfortunately, this is no game or athletic event. This is an act of historic lunacy that has real life ramifications for literally hundreds of millions of people, both here and around the globe. When you are the world’s leading economy, one would think you would have a responsibility to act responsibly but unfortunately, the children masquerading as our political leaders don’t think that way.

In researching this post, we went looking for periods of other such lunacy, hoping and expecting to find some interesting tidbits on such fabled fellows as the pyromaniac Emperor Nero or the fine living Louis XIV of France or even Louis XVI (his grandson, who literally lost his head over what amounted to misuse of sovereign funds).

But under the Google search heading of “Greatest spenders in history” we could only find the name of the 44th president of these United States of America…one Barack Hussein Obama II, formerly known at Punahou School in Honolulu, as Barry Obama…a decent basketball player and apparently somewhat of a connoisseur of the finest pakalolo available in the Hawaiian Isles. Such a standout achievement (the spending, not the smoking) was deemed worthy of our attention so we delved further to discover that, in fact, President Obama may hold the dubious honor of the greatest spender of all time.

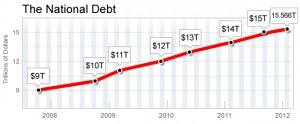

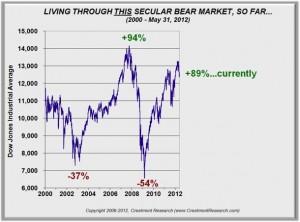

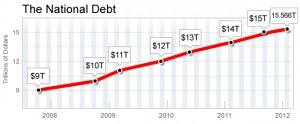

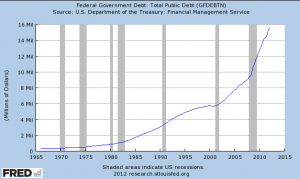

Take a look at the following graph, which shows the progression of the debt total since 2008 (Courtesy of CBS). George W. Bush did a pretty stellar job in his two terms of office, adding almost $4.9 trillion over 8 years but President Obama has eclipsed that amount, ringing in over $5.3 trillion since his inauguration. And let’s not forget…at $100 million per day and about 4 months to go until the election, his could well be an Olympic level performance.

Looking at it another way, under the Obama administration, the U.S. government has accumulated more new debt than it did from the time that George Washington became president right up till William Jefferson Clinton (remember him…good old Bill Clinton) took office.

Now…you’re probably wondering where all that money went as chances are, you are not feeling any wealthier. In fact, during the time of both presidents mentioned above, the real income of the average American has declined, not to mention the horrendous real and imagined (by the BLS folks) unemployment currently beguiling our economy.

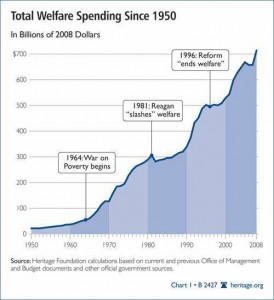

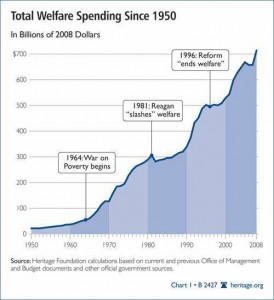

Well, it seems that in addition to waging real wars around the globe, the good old USA has been waging a very expensive war on poverty. Remember, that was the other war that LBJ escalated, aside from the one across the Pacific in Vietnam.

Brief digression…don’t you think that the foreign policy wonks would have thought a bit more about sending troops into a country like Vietnam, which:

- Beat back three invasions by the then master of the universe, Genghis Khan and his Mongol hordes

- Had just recently defeated and thrown out the army of one of the world’s strongest countries…hint…starts with F, ends with E, has a capital city with a large tower and a populace who like to retire early, eat cheese and drink wine…and take August off.

Of course you would think twice after that fiasco, but American foreign policy folks think differently from us. Otherwise, why would they have suggested sending troops into another country, starting with A and ending with the first name of a fabled comedian named Stan (Laurel), after this country…Afghanistan…for those with no sense of phonetics or comedic history…had:

- Never been defeated militarily by the greatest empire of the time, Great Britain

- Just defeated and tossed out one of the most powerful and brutal occupying regimes in history…hint…their country starts with R and ends with A, crosses 22 times zones and has a lot of citizens who enjoy fish eggs and vodka.

So our geniuses figure that in both cases, superior American troops (which may be true) could venture in and win where other much larger and extremely lethal forces had tried and failed. History may not repeat but stupidity and hubris certainly does. Perhaps the same idiocy is behind the massive spending that accompanied and continues to accompany the other LBJ war, that War on Poverty.

So, to get a sense of where the money went…and that is the trail we are following…take a look at this graph.

No gravity here! Just upward and onward...until?

It’s not working so let’s throw some more money at it.

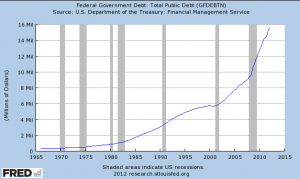

Now take a look at this graph of the national debt over the same period and see if you can see any similarity.

Hmmm...no gravity here either...yet!

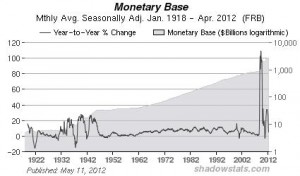

Here we are then…pushing 16 trillion in debt, with 8.3% “official” unemployment and diminishing GDP. Well something must be working, right? All that money, spent on wars and welfare…someone must be better off, aren’t they. Apparently not, at least if you exclude the increasingly wealthy, powerful and influential political and entertainment classes. For the rest of us, US poverty levels are on track to rise to being the highest since the 1960s…when we initially started throwing money at the so-called “War On Poverty”.

http://www.huffingtonpost.com/2012/07/22/us-poverty-level-1960s_n_1692744.html

http://articles.boston.com/2012-07-23/nation/32786966_1_poverty-rate-food-stamps-job-market

At Craven Capital, we are beginning to conclude that the US might be far better off seeking peace on everything, than pursuing war on anything.

And let’s see who else we can blame politically for this mess?

Well, our congressional leaders have done their part, of course. We’ve already seen that Barack Obama is the clear Olympic Champion of Debt, with GW Bush coming in a distant second but still eminently qualified for the team.

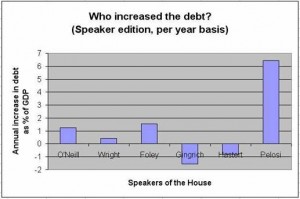

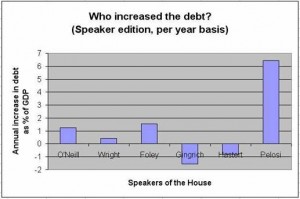

But squandering such large sums is a team effort. It has to be. No one can possibly do it all by themselves. So let’s look at some of the other modern contenders in the following graph.

Gingrich and Hastert are clearly not holding up their part of the debt bargain, but Nancy certainly is!

Well, it looks like the lovely Nancy Pelosi has excelled herself and deserves her place on the Olympic Debt Team of the century. But can we really blame her for taking her eye off the ball…after all, she was spending so much time scrutinizing the 2,700 pages of the Patient Protection and Affordable Care Act (aka Obamacare) it was hard to watch where all the money was going.

Oh…you think that her time was spent granting O-Care waivers to her favored constituents instead? Good point.

http://nation.foxnews.com/nancy-pelosi/2011/05/17/pelosi-caught-hand-obamacare-waiver-cookie-jar

http://theweek.com/article/index/215375/the-obamacare-waivers-in-nancy-pelosis-district-corrupt

But let’s be clear here. This is not a political witch hunt. We’re just having some fun trying to figure out who should qualify for our Olympic Debt Team of the century.

As stated in the previous post, most of us have sipped from the cup of credit at some point and after all, we elected these brilliant individuals and watched our reality shows and sports events while they fiddled in true Nero fashion.

This almost 16 trillion dollar binge that we have been on over the past 20-30 years has fueled the greatest standard of living the world has ever seen, or so we think. It’s not real. It is temporary…a mirage. We have stuff but do we have value? We have been living way above our means for so long that we do not have any idea of what “normal” is anymore. How many bedrooms and bathroom do we really need anyway? As best we can tell, human beings can still only use one toilet at a time.

Let’s face it, you cannot solve a debt problem with more debt. Every debt addict hits “the wall” eventually and the USA will do so as a nation. Can we really afford to be buying processed food for 50 million people and do we really need 4,500 military installations, including 700 bases overseas?

At some point the weight of our national debt is going to cause our financial system to implode, and every American (both born and as yet to be born) will feel the pain of that collapse. Under our current system, there is no mathematical way that this debt can ever be paid back. Our national assets are around $2.7 trillion and our unfunded current and future liabilities exceed 50 trillion (and could be much more). The road that we are on will either lead to default or to hyperinflation or both. We have piled up the biggest debt in the history of the world, and if there are future generations of Americans they will look back and curse us for what we did to them. We have sold them into indentured servitude.

It’s really not about Republicans or Democrats. We’re all to blame. That’s the sad truth and the bad news.

So…is there any good news? And what can we do about this mess anyway?

There is good news and reasons to be optimistic, which we will go into more detail about in future posts. Suffice to say, there is a reason why these United States became the most prosperous country in the history of the world. Part of it is natural and part is human. Stay tuned.

In the meantime, for some comedic relief let’s turn to the most recent BOGUS…err…BLS, numbers. Sorry, but that will have to wait till tomorrow…