Interrupting our discussion on debt to answer a question….

We were asked by a client recently about what we think will happen between now and the end of 2012.

While we are never backward about coming forward with opinions, making predictions is a dangerous game, especially if one is silly enough to attach a date…or worse yet…a time and a date.

But at Craven we are nothing if not keen observers…so let’s do some observing to see if it helps us form an opinion.

Firstly…where are we now? We need to know because it’s hard to get to somewhere if you don’t know where you are.

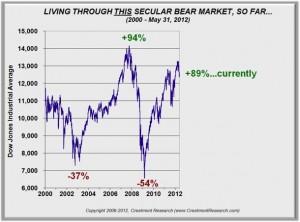

We believe that we are somewhere between 40-60% of our way through a secular bear market. We believe that this bear came out of hibernation in the spring of 2000 and may continue through the end of the decade…but if we have to guess…it will end on April 11, 2019 at 3.21 pm to be exact, at which point, we predict the next secular bull market will begin.

Woops….remember that it’s OK to make predictions, just don’t attach a date and especially a time. Oh well, let’s see how that one turns out.

But returning to being serious…yes, we believe that we are approximately midway through a secular bear market. Why do they call it “secular”? It is loosely derived from the old latin word for “era” so a secular bear market is a market for our era…in other words, for too long. The last secular bull market ran from the early 80s to the late, late 90s and a bit beyond but it ultimately crashed when the inevitable pin came in contact with a very large technogoly/internet inflated bubble.

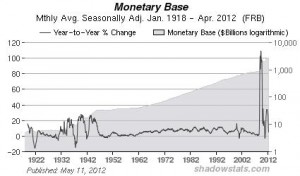

After that, Alan (let’s paint the town gray) Greenspan did what central bankers do best…created another bubble, this time in real estate, by deflating rates and pumping money into the economy. Real estate owners thought they were rich and getting richer and turned their homes into ATMs from which they made up for lost earning power and demolished portfolios by sucking out the equity in their homes. In other words, they supped heartily from the Fed filled cup of credit. We’ll come back to that debt discussion in future posts.

So even though the early 2000s felt good, it was a sugar high and we were really in the early throes of the bear market. 2008 was a wake-up call for everyone except those few who were the most alert and now we find ourselves in the grip of a pretty cranky bear…a close relative of that same angry bear that reigned supreme from 1965 through the late 70s and early 80s.

Take a look at the two graphs that follow…courtesy of Ed Easterling and the very wise folks at Crestmont Research.

But what has all this got to do with a prediction for what might happen between right now through the end of the year?

Actually, quite a lot because we think that we are now entering a soft patch within an extended sea of quicksand.

Despite Gentle Ben’s money printing and yakking the market up, there are signs of cracking everywhere. The ECRI Weekly Leading Index is indicating a recession is either here now or will begin in the next few months…and will probably be really noticed by most people after all the election hoopla is behind us.

Let’s take a look at some of these indicators:

- Consumer confidence is sagging. Both the Conference Board index and the University of Michigan Survey are at their lowest levels of 2012.

- Vehicle sales are dragging with May and June being the two weakest months of the year (wait, that’s because the warmer weather induced everyone to buy earlier…er…OK). What if it didn’t?

- Retail sales have dropped for three consecutive months. This is a relatively rare event. It happened four times in 2008 but you had to go back to that angry bear in 1967 for the last one before that.

- On the much vaunted manufacturing front, the ISM manufacturing index for June fell 3.8 points to 49.7, its first sub-50 reading since the so called recovery began.

- The ISM non-manufacturing index for June dropped to its lowest level since January 2010.

- Factory orders are down and plans for capital spending and new hiring have dropped sharply.

- The Philadelphia Fed Survey for July was negative (below zero) for the third consecutive month.

- The small business confidence index declined in June to its lowest level since October and has now dropped in three of the last four months. No wonder…with all the bad stuff happening in the economy already and then toss in Obamacare. Small business is the lifeblood of the country but for how much longer? [Side note..we happen to believe that small business will make a big, big comeback one day…but no exact date or time here].

- On the all important jobs front June payroll numbers were weak once again and averaged only 75,000 in the second quarter (that’s if you believe the BOGUS…we mean the..BLS numbers). But even by “official” numbers, the latest weekly new claims for unemployment insurance jumped back up to 386,000 and the last two months have been well above the numbers seen earlier in the year.

- June existing home sales fell 5.4% to its lowest level since the fall of last year and mortgage applications for home purchases have been stagnant, despite the record low rates.

- Europe continues to be a mess with a number of the EZ countries already officially in recession. And keep a keen eye on Spanish (and Italian) bond rates.

- The Shanghai Composite is in a major downtrend, declining 28% since April 2011. China is coming down from a major real estate and credit boom and a hard landing is imminent.

In the meantime, the stock market is ignoring these fundamentals as it did back in early 2000 and late 2007 while it relies on Gentle Ben to come to the rescue yet again. And he will.

But each time he comes back with a fresh bottle of vodka to refresh the punch bowl, poor old Ben has had to sneak more and more water into that vodka bottle to make it appear like it is full of the real stuff. So with each additional replenishment, party goers are getting less of a buzz and that fading feeling is starting to happen much sooner than it did the first or second time.

What’s vodka and a punchbowl and a party have to do with economic predictions you might say? Well, in the world of crony-capitalism….everything. Replace vodka with funny money and party goers with proprietary traders and market speculators and you have the real world in which we live.

The market is waiting on Ben to print more money (pour more vodka). President Barack is eager to help him pour because he would like to see a juiced up market heading into November. The market expects Ben to pour and Barry to tilt his elbow up even further to increase the flow.

But the indicators on Main St. tell us otherwise. While volatility is almost non-existent, the 10-year treasury yield hovers persistently south of 1.5% and is slipping quietly toward 1.45%.

So….finally…our prediction! Well, it’s not so much of a predication as an opinion. And if you are in the money management business, you’d better have an educated opinion because as the old saying goes…”if you don’t stand for something, you’ll fall for anything”.

Thus, while the economic indicators are telling that we are heading into another period of slow, or no, growth…the market is expecting another thing. Therefore we predict / opine that they will both be right.

In the short term, we expect the market to pull back, which may create a lovely buying (or put selling) opportunity. This pull back will be met with more vodka into the US and (most likely) the global punchbowl. The party goers will celebrate accordingly, causing the market to rebound quite smartly through year-end…or at least through the election.

Thereafter, however, things will probably turn ugly as even the market realizes that a lot of that vodka was just plain tap water. Market euphoria could rapidly turn into a hangover of gargantuan proportions. That will be very bad for the market…but possibly very good for those bargain hunters among us.

Remember, we are in the middle of a secular bear market. Right now the bear may be taking an afternoon nap but he’s not hibernating. Invest accordingly.